Have you ever looked at a beautiful luxury estate in Cape Town or a prime city apartment in Gauteng and wished you could own a piece of it, but knew the price tag was impossible? For a long time, the best real estate was only available to those with huge amounts of cash. But that has changed completely.

The revolution is called Fractional Ownership, a cutting-edge investment strategy that is democratizing access to high-value assets, particularly top properties in South Africa. It allows you to become a property owner and benefit from passive rental income and capital growth without needing all the money or dealing with all the hassles. If you want to invest in South Africa's top properties smart way, this guide is for you.

1. How Does Fractional Ownership Work?

Fractional Ownership is a method where several unrelated parties can share in the ownership of a high-value tangible asset.

While it is often used for assets like jets, yachts, or resort real estate, its fastest growth area in South Africa is in property investment.

The Core Principle: Shared Ownership

The concept is simple: instead of buying the whole house or apartment yourself, you buy a portion, a "share" or "fraction" of the property's legal title.

Shared Title:

You are a legal owner, but your ownership percentage is defined by the size of your investment.

Lower Entry Cost:

This significantly lowers the entry cost, allowing you to invest in top properties that would otherwise be out of reach. For example, instead of needing R5 million, you might buy a 1% share for R50,000.

Mitigate Risk:

By sharing the cost and legal ownership with others, you are also sharing and reducing risk and exposure.

Two Main Types of Fractional Ownership in SA

In the context of investing in South Africa's top properties, fractional ownership typically takes one of two primary forms:

A. Direct Property Share Schemes (Lifestyle & Investment)

This is when you buy a share in a specific, high-end property—often a luxury holiday home in a sought-after location like Cape Town, KwaZulu-Natal, or a private game reserve.

Dual Benefit:

This type often combines investment with lifestyle. You benefit from the property's appreciation and sometimes passive rental income, but you also receive the right to use the property for a set number of weeks per year (e.g., four weeks).

Management:

A dedicated fractional ownership provider handles all maintenance, insurance, and utilities, offering you hassle-free management.

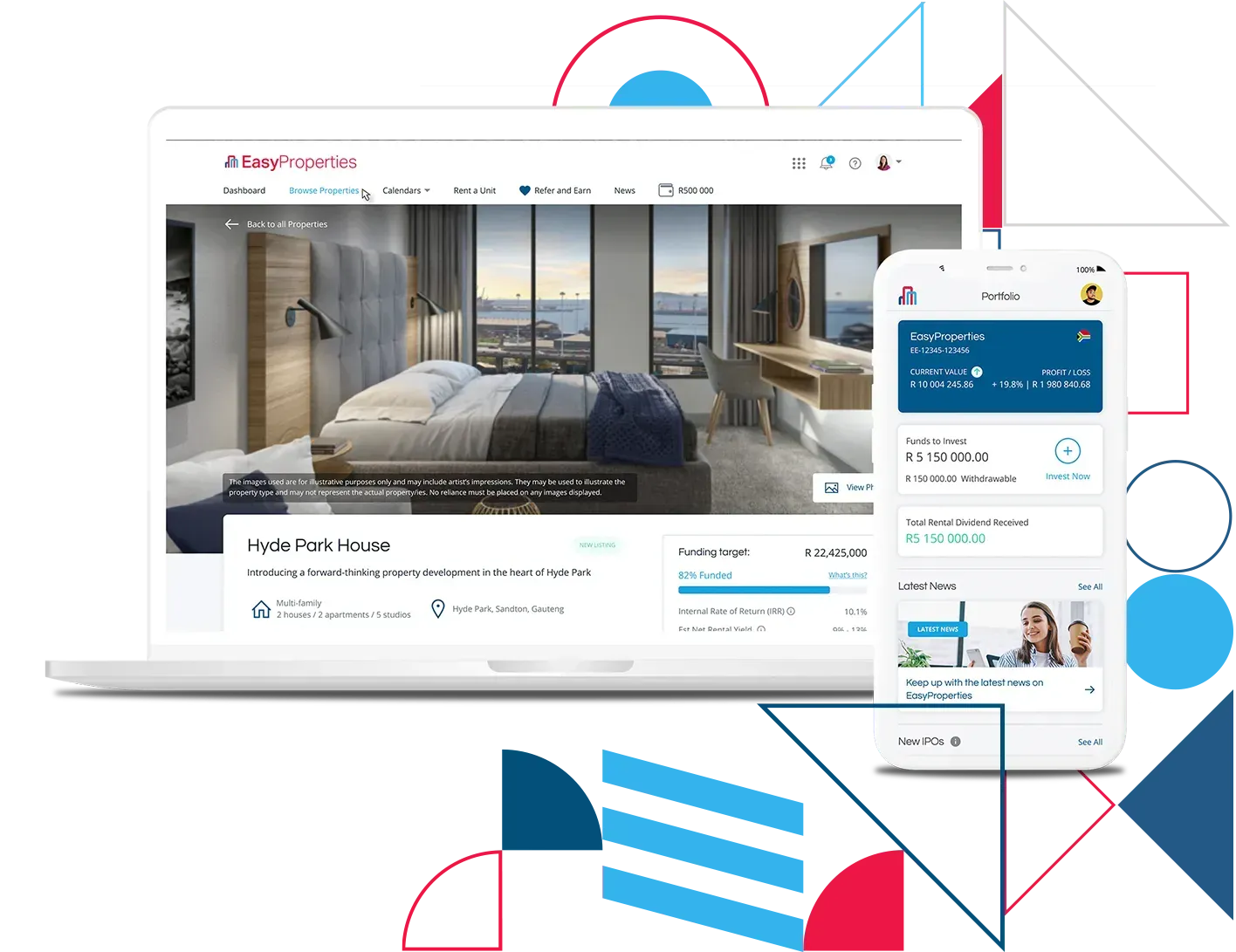

B. Investment Platforms (Pure Investment)

This is the more common and purely passive way to invest, often through local platforms like EasyEquities or FracProp which offer access to property shares or ETFs (Exchange Traded Funds) linked to property.

Real Estate Investment Trusts (REITs):

When you invest in a REIT through an ETF, you are indirectly buying a fraction of a large portfolio of income-producing properties (like malls, offices, or residential blocks). This is a highly liquid form of fractional ownership focused solely on generating passive rental income (dividends) and capital growth.

Democratization:

This method completely democratizes access to high-value real estate, allowing you to start investing with a very small amount of money.

2. Benefits of Fractional Ownership: Why it is a Smart Investment

Fractional Ownership is considered a smart and innovative way to invest in property in South Africa because it solves many of the traditional problems associated with real estate.

Lower Financial Barriers to Entry

The single biggest benefit is the ability to access high-quality assets with significantly lower upfront investment.

Access to Top-Tier Properties: You gain access to a diverse portfolio of prime properties in the most sought-after locations across South Africa that you could never afford to buy outright.

Effective Use of Capital: Instead of having R1 million tied up in one small property, you can spread that R1 million across 10 or 20 different top properties, optimizing your capital and reducing risk.

Hassle-Free, Passive Rental Income

Traditional property ownership is anything but passive, it involves late-night calls about leaky pipes, tenant screening, and constant maintenance.

Fractional Ownership eliminates this stress.

Hands-off Management: The fractional ownership providers or fund managers take care of all the hassles of property management, including maintenance, dealing with tenants, collecting rent, and administrative work.

Passive Income Stream: Your share of the rental income is automatically paid out to you, creating a true passive income stream.

Powerful Diversification Strategy

Fractional ownership is a great way to diversify your investment portfolio beyond just stocks and bonds, which helps to reduce your overall risk.

Geographic Diversity: You can easily own shares in properties located in different areas (Cape Town, Gauteng, KwaZulu-Natal) or different sectors (residential, commercial, retail). This protects you if one market experiences a downturn.

Asset Class Diversity: Adding a tangible asset like property provides a necessary hedge against inflation, strengthening your overall investment portfolio.

3. What Are the Downsides of Fractional Ownership? (The Risks)

While Fractional Ownership offers a plethora of advantages, it is essential to understand the potential downsides and risks before you invest. A smart investor knows all the angles.

Limited Liquidity and Resale

The biggest potential problem, especially with direct holiday home schemes, is liquidity.

Slower to Sell:

Selling a fractional share of a specific house is usually more complicated and slower than selling an entire property or a share of an ETF. You often rely on the provider or the fractional market to find a buyer.

Transaction Costs:

Listing and transfer fees can sometimes be high, impacting your net returns.

Shared Decision Making and Usage Restrictions

When you share ownership, you lose the ability to make 100% of the decisions.

Management Dependency:

You are completely reliant on the professional management company to maintain the property well and find good tenants. If they do a poor job, your investment suffers, but you have limited recourse.

Usage Constraints (For Lifestyle Schemes):

If you bought a share for personal use, you only have the right to use the property for a fixed number of weeks per year, and these usage schedules must be planned and adhered to.

Fees and Contracts

You must carefully review all contracts and fees, as these can chip away at your profits.

Monthly Fees:

As a fractional owner, you'll be responsible for paying monthly management or levy fees, even if the property is vacant.

Complexity:

The contracts can be complex, involving multiple parties and detailed rules and regulations. It is vital to understand the exit strategy and all clauses regarding maintenance reserves and capital expenditure.

4. Getting Started with Fractional Ownership in South Africa

If you are looking for a smart and innovative way to invest in property in South Africa, here is how to take action and minimize the risks.

A. Choose Your Investment Focus

Decide whether your goal is pure passive income or a mix of investment and personal use.

Pure Passive Income: Focus on REIT ETFs on platforms like EasyEquities. This offers the highest liquidity, lowest costs, and greatest diversification.

Lifestyle & Asset Growth: Research reputable fractional ownership providers who specialize in specific luxury or resort properties. These require more capital and due diligence.

B. Do Your Due Diligence

Before you commit any capital, thorough research is key.

Analyze the Provider: Research the track record and reputation of the fractional ownership provider (e.g., FracProp). Look at their management fees, their history of rental occupancy, and their maintenance schedules.

Review the Contract: Pay close attention to the rules regarding management, fees, and the specific terms for selling your fraction. Understand the governance structure—who makes the big decisions about major repairs?

Understand the Asset: Whether it's an ETF or a specific apartment, analyze the underlying asset's location and market potential. Does the property have strong prospects for capital growth?

C. Manage Your Investment

As a fractional owner, your job is simple:

Pay Your Fees: Ensure your monthly management fees are paid promptly.

Monitor Performance: Regularly review the rental income and the appreciation value reported by the manager.

Stay Informed: Follow the rules and regulations of the program, especially regarding any scheduled maintenance or voting on major property decisions.

Fractional ownership allows you to leverage the stability of real estate without getting bogged down in the day-to-day hassles.

It is an ideal way to diversify your portfolio and build wealth over time in the dynamic South African market.

Ready to unlock the potential of property investment without a massive down payment? Fractional ownership is your bridge to accessing South Africa's premium real estate market.

Visit and REGISTER at a reputable Fractional Ownership Provider TODAY! They will be able to answer all your questions and help you find the perfect fractional ownership property for your needs.

General Disclaimer: Your Growth Compass is an educational and informational platform, not a registered financial advisory service. All cryptocurrency and investment information provided is for educational purposes only. Bitcoin and other digital assets are highly volatile and inherently risky. We are not liable for any financial losses, profits, or investment decisions you make. Always conduct your own due diligence or consult a certified financial professional before investing

Latest Articles

© 2025 Your Growth Compass SA All Rights Reserved