Disclaimer

The information provided in this article is for educational and informational purposes only and does not constitute professional financial, legal, or tax advice. While we strive to ensure the accuracy of the strategies discussed, South African tax laws and investment regulations are subject to change. Every individual’s financial situation is unique; therefore, you should consult with a certified financial planner or a registered tax professional before making any investment decisions. Your Growth Compass is not a financial services provider (FSP), and some links included may be affiliate links that support our platform at no additional cost to you.

People searching for Tax-efficient investing strategies are typically South African taxpayers, entrepreneurs, or young professionals looking to optimize their wealth. They seek actionable ways to reduce their tax liability to SARS while growing their investment portfolios. They expect to find a comparison of local investment vehicles, legal tax loopholes, and strategies that balance liquidity with long-term growth.

For many young entrepreneurs and startup founders in South Africa, the journey into wealth creation usually begins with a simple savings account. However, to build true, sustainable wealth, you must understand tax-efficient investing SA. While the Tax-Free Savings Account (TFSA) is a fantastic starting point, it has annual limits that high-growth individuals quickly outpace.

If you are looking to scale your capital, you need to look at more sophisticated structures. This guide explores how you can minimize your "tax leakage" and keep more of your hard-earned profits working for you.

Why Tax-Efficient Investing SA Matters for Entrepreneurs

As a startup founder, your biggest expense isn't usually your rent or your staff, it’s tax. Every Rand you pay in unnecessary tax is a Rand that isn't being reinvested into your business or your future.

Tax-efficient investing SA isn't about evading tax; it’s about using the legal frameworks provided by SARS to defer, reduce, or eliminate tax liabilities. By choosing the right investment vehicles early, you can significantly alter your wealth trajectory over the next decade.

Strategy 1: Maximizing the TFSA vs RA Debate

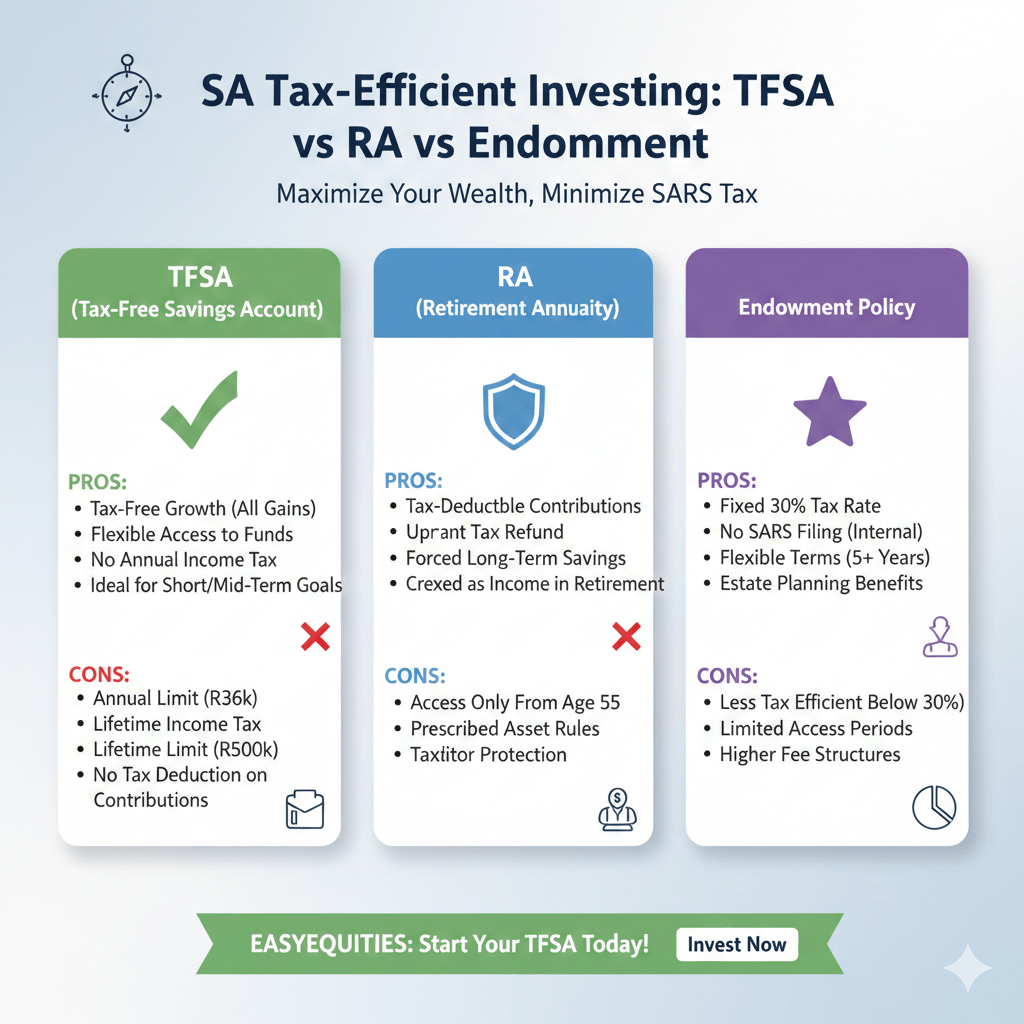

The most common question for South African youth is the TFSA vs RA dilemma. Both offer tax benefits, but they serve different purposes for a growing business owner.

A TFSA allows you to invest up to R36,000 per year with no tax on dividends, interest, or capital gains. However, a Retirement Annuity (RA) allows you to deduct your contributions from your taxable income (up to 27.5% of your remuneration, capped at R350,000 per year).

When a Retirement Annuity Outperforms a TFSA

If you are in a high tax bracket, the immediate tax refund from an RA can be reinvested back into your startup. This provides an immediate boost to your cash flow that a TFSA cannot offer. For a beginner-to-intermediate investor, balancing both is often the best path to tax-efficient investing SA.

Strategy 2: Navigating SARS Section 12J Alternatives for Capital Growth

In years past, Section 12J was the "holy grail" of startup tax strategies South Africa. It allowed investors to deduct 100% of their investment from their taxable income. While that specific incentive has sunset, new avenues have emerged.

Entrepreneurs are now looking at specialized Venture Capital Companies (VCCs) and "Small Business Corporation" (SBC) tax rates. If your startup qualifies as an SBC, you pay 0% tax on the first segment of your taxable income and a reduced rate thereafter. Reinvesting these savings into growth assets is a core pillar of tax-efficient investing SA.

Strategy 3: Utilizing Capital Gains Tax (CGT) Exemptions for SA Small Businesses

One of the most overlooked startup tax strategies South Africa is the "Small Business Venture" CGT exemption. When you eventually sell your startup, SARS allows a specific exclusion for capital gains if you are over 55 or if the business meets certain requirements.

Even for younger entrepreneurs, structuring your business assets correctly from day one ensures that you don't lose 18% or more of your exit value to CGT. Always consult a professional to ensure your shareholding structure qualifies for these primary residence or small business exemptions.

Strategy 4: Retirement Annuity vs. Endowment for High-Earners South Africa

As your startup grows and your personal income increases, you may find yourself in the 45% tax bracket. This is where the Retirement Annuity vs. Endowment for high-earners South Africa conversation becomes vital.

Retirement Annuities: Great for tax deductions, but your money is locked away until age 55.

Endowments: These are taxed at a flat rate of 30% within the "wrapper."

If your personal tax rate is higher than 30%, an endowment can actually save you 15% in tax on your investment growth. This is a powerful tool for intermediate investors who need more flexibility than an RA provides.

Strategy 5: Smart Startup Tax Strategies South Africa: Reinvesting Profits

The most effective form of tax-efficient investing SA for a founder is often "Internal Reinvestment." By keeping profits within the company to fund research, development, or new hires, you reduce your company's taxable income.

This "pre-tax" growth is often more valuable than taking a high salary, paying 45% income tax, and then trying to invest what is left. It allows you to build a more valuable asset while maintaining a lower personal tax profile.

Common Mistakes to Avoid in Tax-Efficient Investing SA

Ignoring the TFSA Limit: Over-contributing to your TFSA results in a 40% penalty from SARS.

Focusing Only on Tax: Never let the "tax tail wag the investment dog." A bad investment with great tax perks is still a bad investment.

Lack of Liquidity: Locking all your capital in RAs can be dangerous for a startup founder who might need emergency cash for the business.

Key Takeaways

Start with a TFSA to build a tax-free foundation.

Use RAs to lower your taxable income if you are in a high bracket.

Explore SBC tax rates to keep more profit in your startup.

Consider Endowments if your personal tax rate exceeds 30%.

Plan for your "exit" early to take advantage of CGT exemptions.

Conclusion: Building Your Growth Compass

Mastering tax-efficient investing SA is the difference between struggling for cash flow and building a financial empire. For South African entrepreneurs and youth, the goal is to create a diversified portfolio that minimizes what you owe to SARS and maximizes what you keep.

While advanced strategies like endowments and SBC structures are powerful, everyone should start with the basics. If you haven't yet maxed out your annual contribution, opening a Tax Free Savings Account (TFSA) remains the most accessible way to begin your journey toward financial freedom.

Visit Your Growth Compass for more insights on how to navigate the South African investment landscape.

Don’t let "tax-leakage" slow down your journey to financial independence. While advanced strategies are vital as you scale, the most expensive mistake you can make is waiting for the "perfect time" to start.

Every year you don't use your tax-free allowance is an opportunity lost forever.

Take the first, easiest step toward a tax-efficient future right now. By starting with a TFSA, you ensure that every cent of your interest, dividends, and growth stays exactly where it belongs: in your pocket.

General Disclaimer: Your Growth Compass is an educational and informational platform, not a registered financial advisory service. All cryptocurrency and investment information provided is for educational purposes only. Bitcoin and other digital assets are highly volatile and inherently risky. We are not liable for any financial losses, profits, or investment decisions you make. Always conduct your own due diligence or consult a certified financial professional before investing

Latest Articles

© 2025 Your Growth Compass SA All Rights Reserved